Capital Projects & Real Estate Delivery

Madison Park Apartments - $2M Hybrid Redevelopment

Led a $2M hybrid redevelopment of a distressed multifamily asset using a Waterfall–Agile delivery model to stabilize operations, modernize units, and optimize cash flow. The initiative introduced deterministic construction sequencing, parallel turnovers, and transparent financial reporting to increase NOI while maintaining tenant retention during renovations.

Year :

2022

Industry :

Real Estate Development | Multifamily

Client :

Real Estate Investment Group

Project Duration :

Multi-phase stabilization & renovation

PROBLEM :

Unit renovations were causing significant cash-flow disruption due to non-deterministic construction sequencing and overlapping renovation states. Units cycled through multiple scopes simultaneously, confusing contractors, delaying leasing, and increasing vacancy costs. Financial reporting lacked clarity around unit status, timelines, and budget attribution, making it difficult for investors to understand progress or forecast NOI during the value-add phase.

SOLUTION :

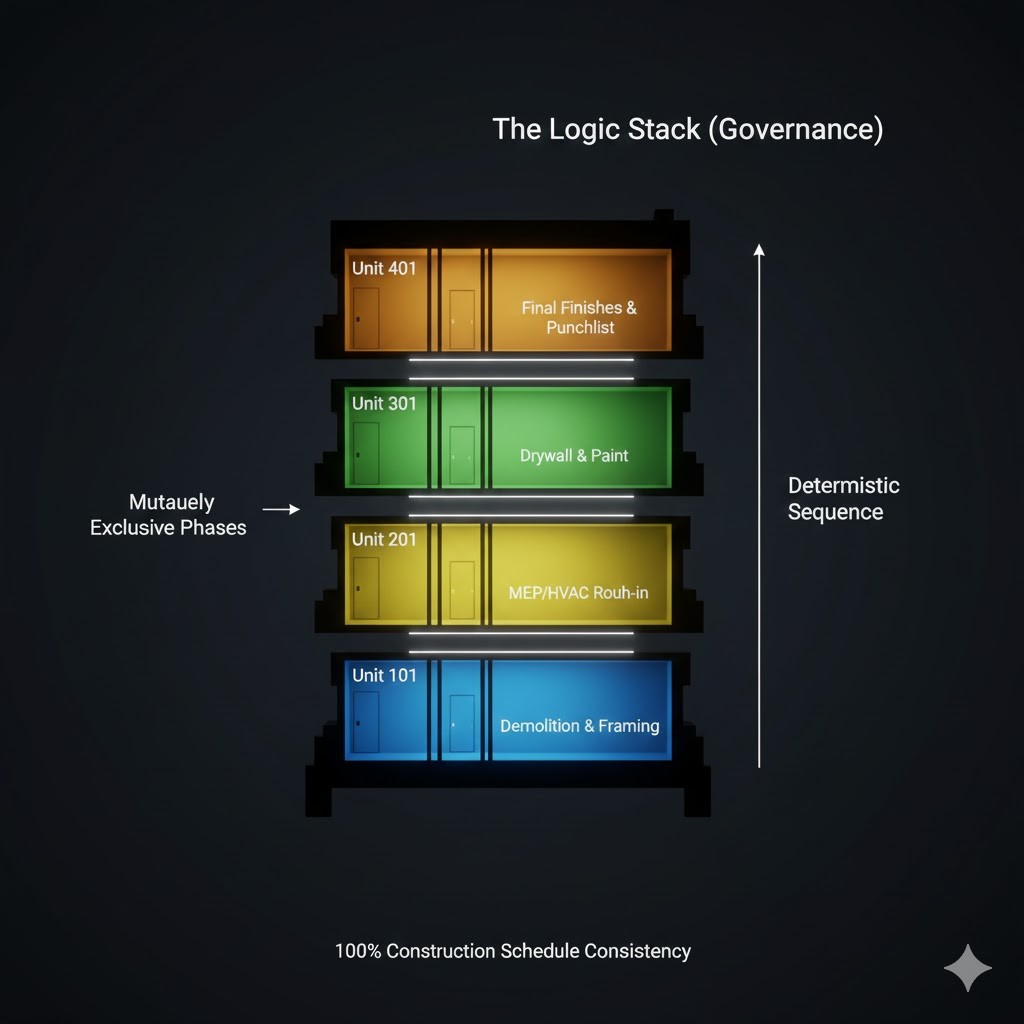

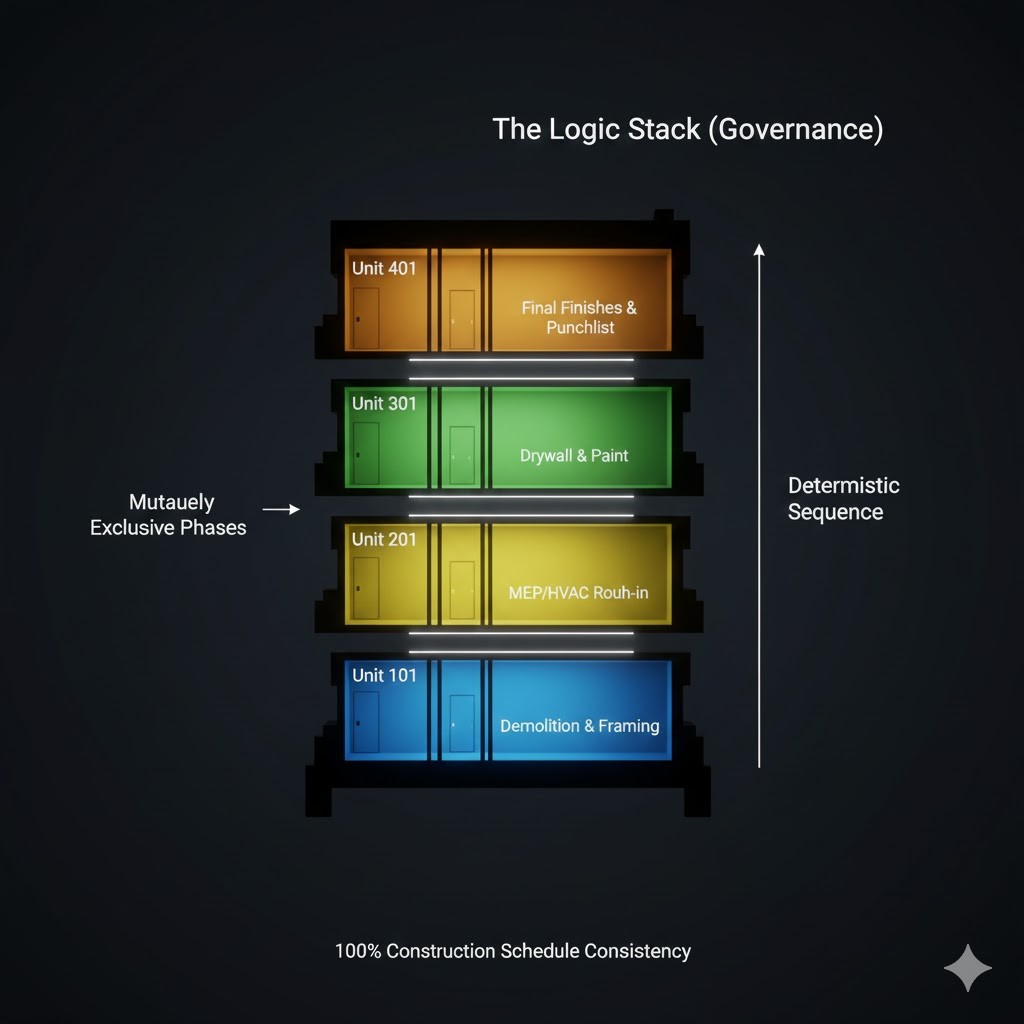

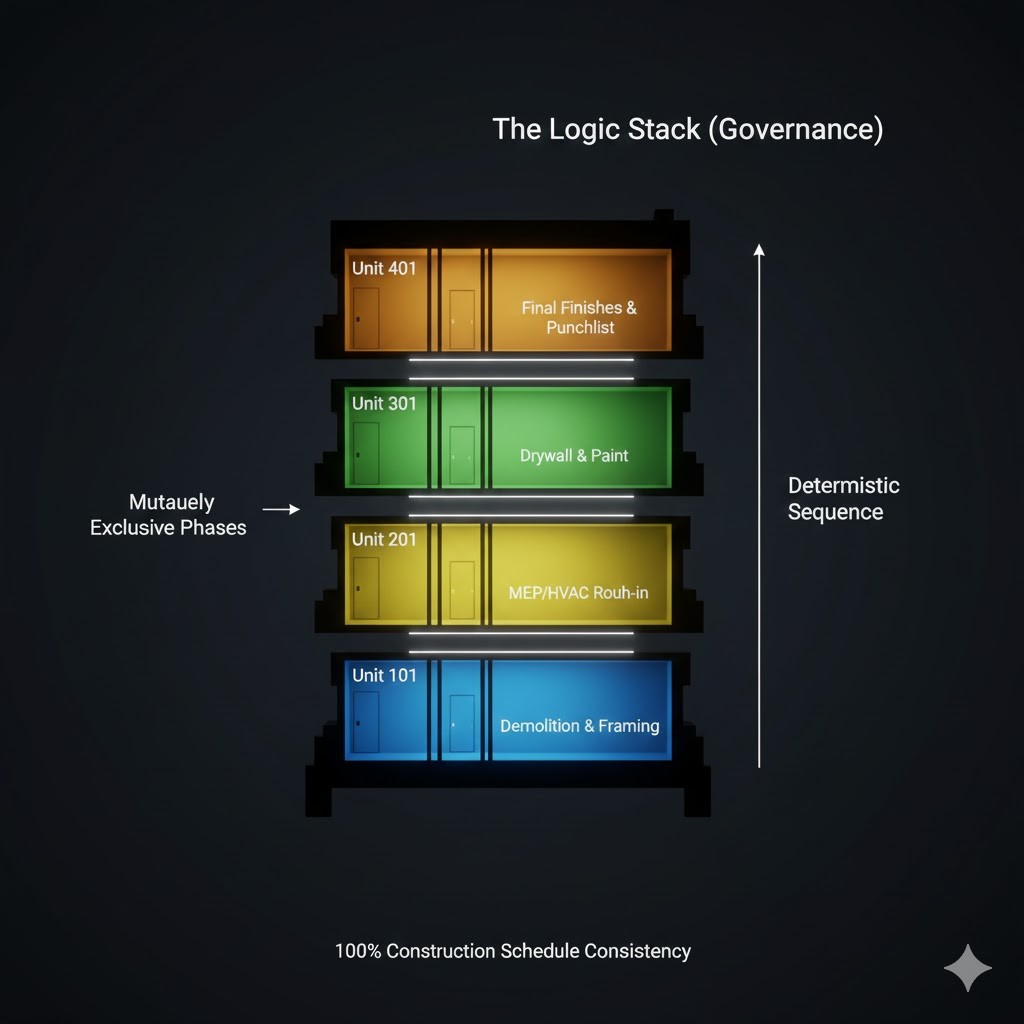

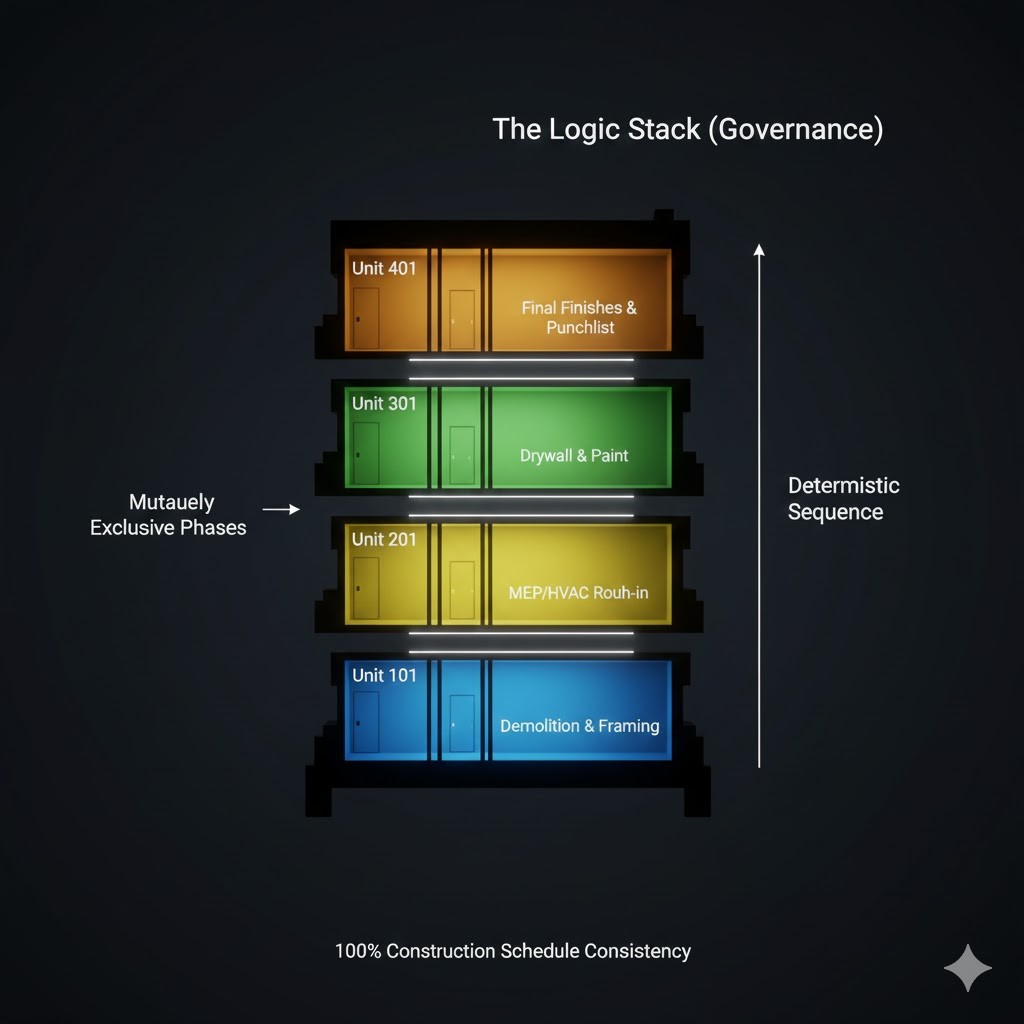

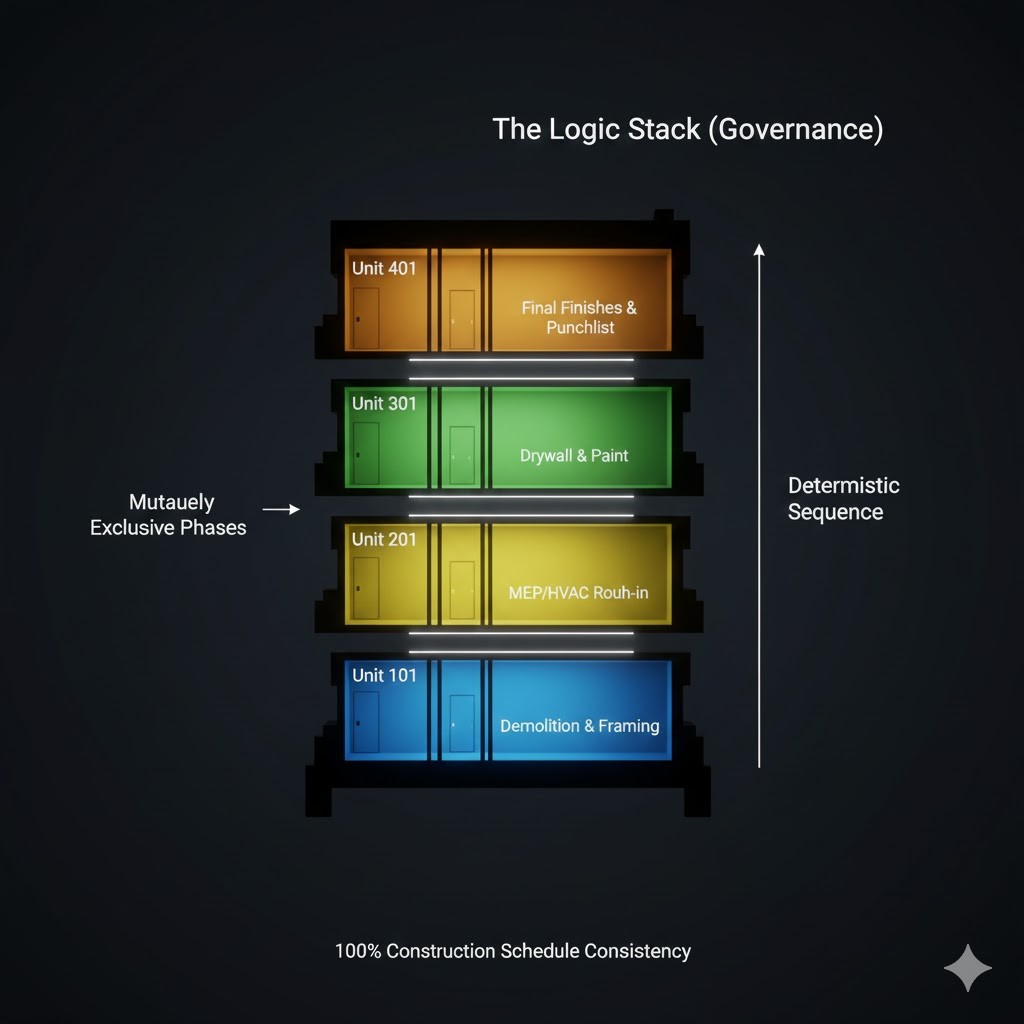

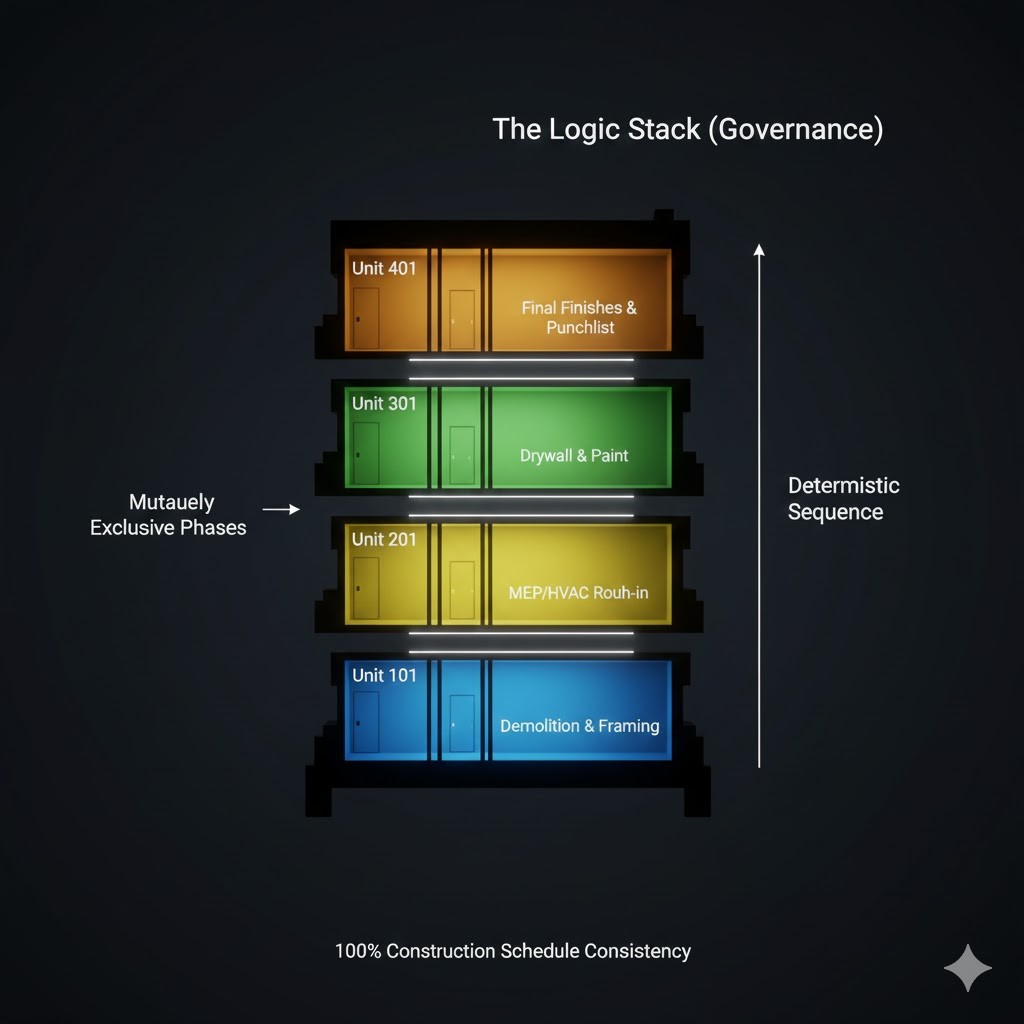

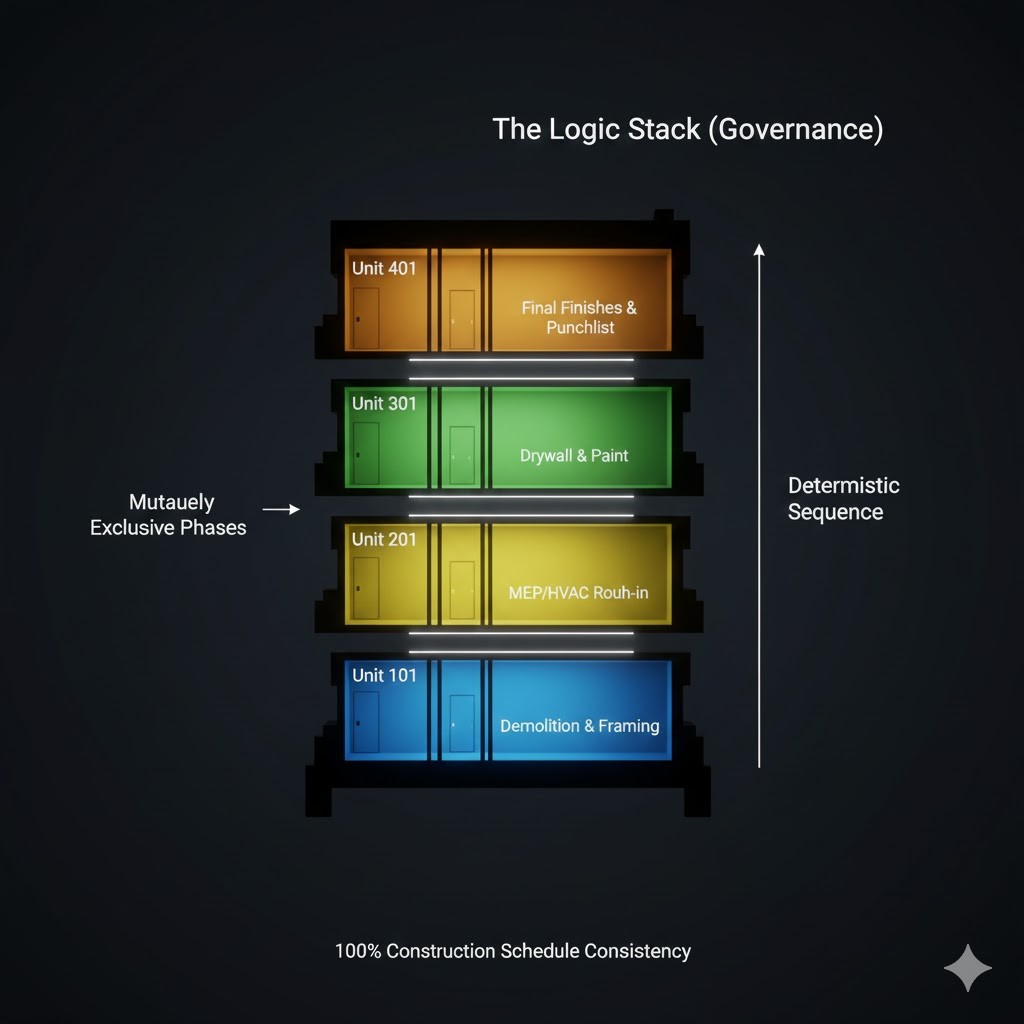

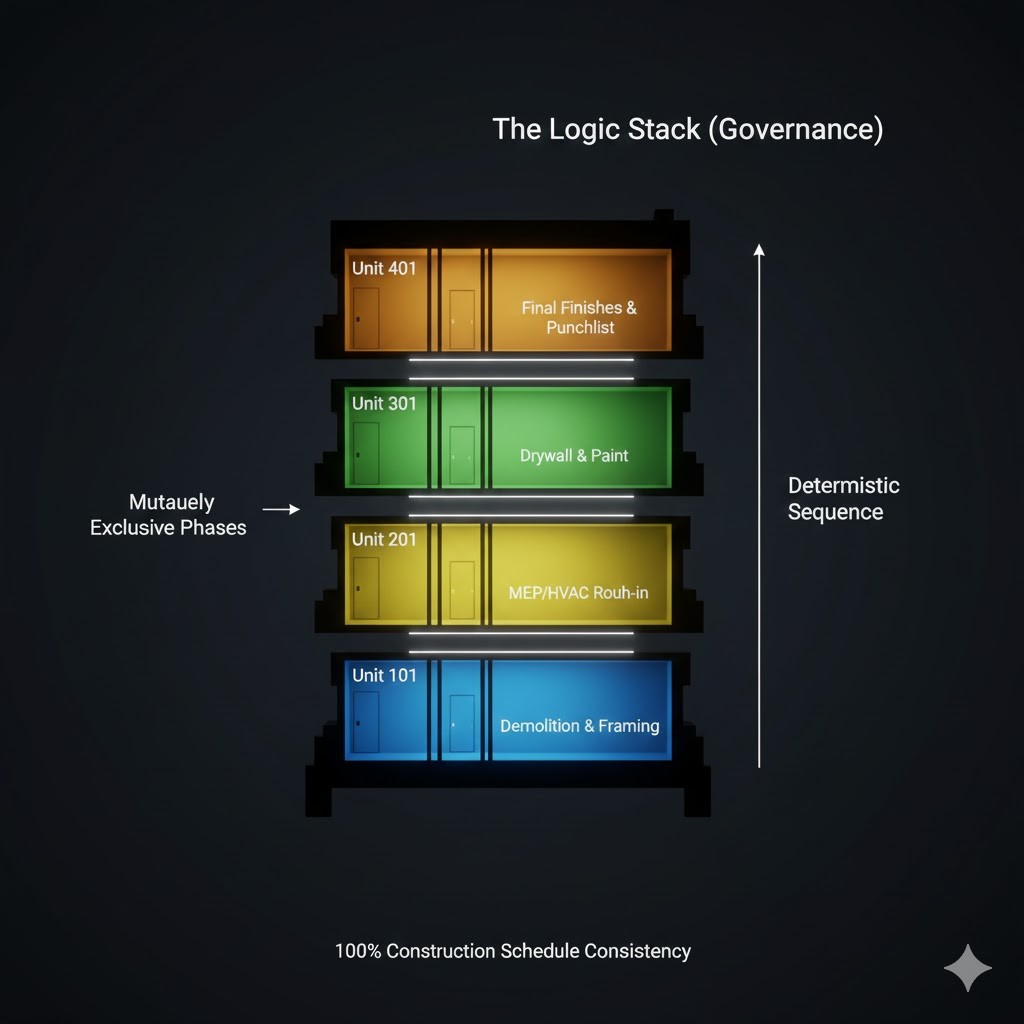

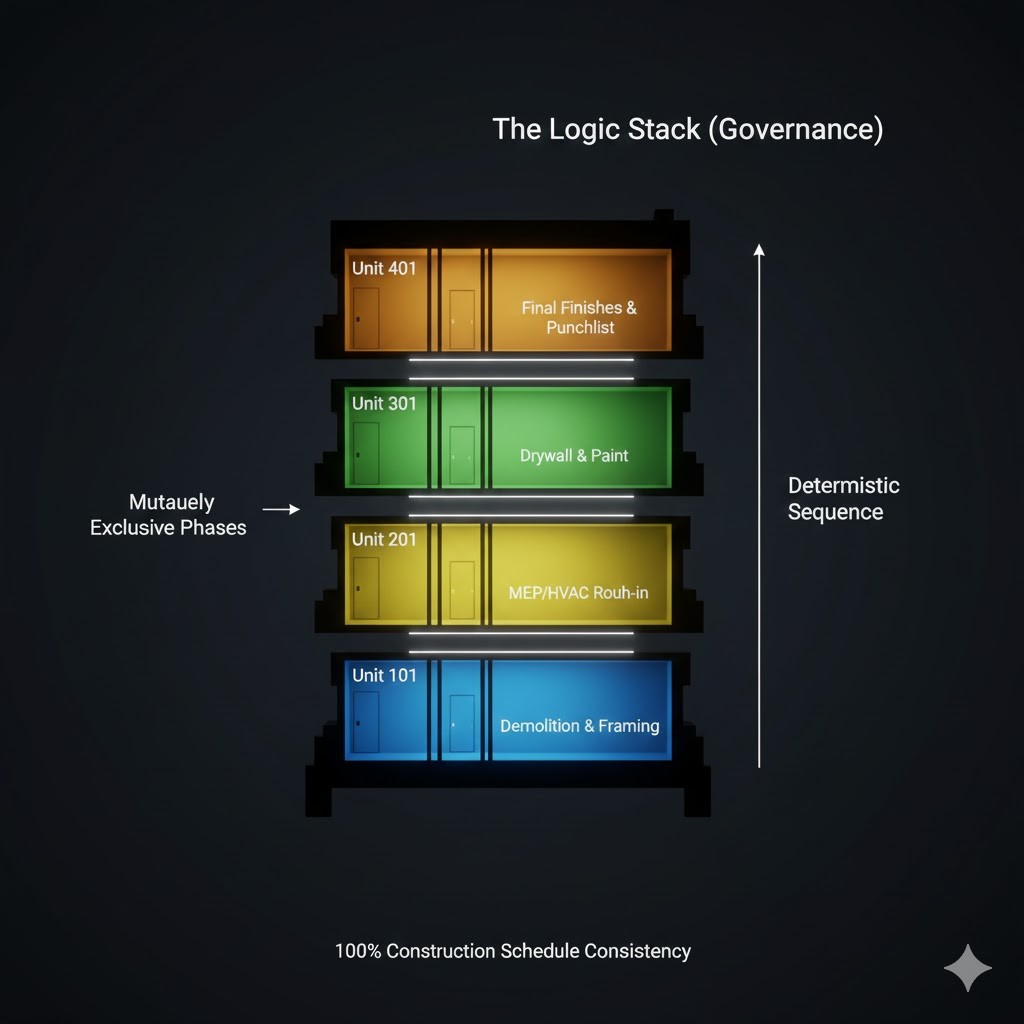

I redesigned the renovation and turnover model using a hybrid PM approach, Waterfall for asset-level governance and Agile for unit-level execution. The solution introduced mutually exclusive renovation phases with strict priority logic, deterministic scheduling rules, and parallel construction strategies to minimize vacancy loss. A transparent owner dashboard aligned construction status with financial impact, enabling real-time visibility into unit progress, budget accuracy, and NOI optimization.

CHALLENGE :

Contractors were accustomed to traditional sequential workflows and resisted the hybrid model, as they were concerned it would create confusion during the transition. To mitigate risk, I implemented a parallel pilot that ran legacy and hybrid sequencing in parallel, allowing for validation without disrupting live operations. Data-driven comparisons demonstrated improved rental revenue capture and eliminated schedule conflicts, securing full adoption.

SUMMARY :

The redevelopment delivered 15% rental income optimization, 100% deterministic construction sequencing, and 30% improvement in operational communication efficiency. Investor clarification requests dropped significantly due to improved financial transparency, and the asset achieved stabilized performance ahead of projections. The project established a scalable hybrid redevelopment model supporting future acquisitions and long-term portfolio growth.

More Projects

Capital Projects & Real Estate Delivery

Madison Park Apartments - $2M Hybrid Redevelopment

Led a $2M hybrid redevelopment of a distressed multifamily asset using a Waterfall–Agile delivery model to stabilize operations, modernize units, and optimize cash flow. The initiative introduced deterministic construction sequencing, parallel turnovers, and transparent financial reporting to increase NOI while maintaining tenant retention during renovations.

Year :

2022

Industry :

Real Estate Development | Multifamily

Client :

Real Estate Investment Group

Project Duration :

Multi-phase stabilization & renovation

PROBLEM :

Unit renovations were causing significant cash-flow disruption due to non-deterministic construction sequencing and overlapping renovation states. Units cycled through multiple scopes simultaneously, confusing contractors, delaying leasing, and increasing vacancy costs. Financial reporting lacked clarity around unit status, timelines, and budget attribution, making it difficult for investors to understand progress or forecast NOI during the value-add phase.

SOLUTION :

I redesigned the renovation and turnover model using a hybrid PM approach, Waterfall for asset-level governance and Agile for unit-level execution. The solution introduced mutually exclusive renovation phases with strict priority logic, deterministic scheduling rules, and parallel construction strategies to minimize vacancy loss. A transparent owner dashboard aligned construction status with financial impact, enabling real-time visibility into unit progress, budget accuracy, and NOI optimization.

CHALLENGE :

Contractors were accustomed to traditional sequential workflows and resisted the hybrid model, as they were concerned it would create confusion during the transition. To mitigate risk, I implemented a parallel pilot that ran legacy and hybrid sequencing in parallel, allowing for validation without disrupting live operations. Data-driven comparisons demonstrated improved rental revenue capture and eliminated schedule conflicts, securing full adoption.

SUMMARY :

The redevelopment delivered 15% rental income optimization, 100% deterministic construction sequencing, and 30% improvement in operational communication efficiency. Investor clarification requests dropped significantly due to improved financial transparency, and the asset achieved stabilized performance ahead of projections. The project established a scalable hybrid redevelopment model supporting future acquisitions and long-term portfolio growth.

More Projects

Capital Projects & Real Estate Delivery

Madison Park Apartments - $2M Hybrid Redevelopment

Led a $2M hybrid redevelopment of a distressed multifamily asset using a Waterfall–Agile delivery model to stabilize operations, modernize units, and optimize cash flow. The initiative introduced deterministic construction sequencing, parallel turnovers, and transparent financial reporting to increase NOI while maintaining tenant retention during renovations.

Year :

2022

Industry :

Real Estate Development | Multifamily

Client :

Real Estate Investment Group

Project Duration :

Multi-phase stabilization & renovation

PROBLEM :

Unit renovations were causing significant cash-flow disruption due to non-deterministic construction sequencing and overlapping renovation states. Units cycled through multiple scopes simultaneously, confusing contractors, delaying leasing, and increasing vacancy costs. Financial reporting lacked clarity around unit status, timelines, and budget attribution, making it difficult for investors to understand progress or forecast NOI during the value-add phase.

SOLUTION :

I redesigned the renovation and turnover model using a hybrid PM approach, Waterfall for asset-level governance and Agile for unit-level execution. The solution introduced mutually exclusive renovation phases with strict priority logic, deterministic scheduling rules, and parallel construction strategies to minimize vacancy loss. A transparent owner dashboard aligned construction status with financial impact, enabling real-time visibility into unit progress, budget accuracy, and NOI optimization.

CHALLENGE :

Contractors were accustomed to traditional sequential workflows and resisted the hybrid model, as they were concerned it would create confusion during the transition. To mitigate risk, I implemented a parallel pilot that ran legacy and hybrid sequencing in parallel, allowing for validation without disrupting live operations. Data-driven comparisons demonstrated improved rental revenue capture and eliminated schedule conflicts, securing full adoption.

SUMMARY :

The redevelopment delivered 15% rental income optimization, 100% deterministic construction sequencing, and 30% improvement in operational communication efficiency. Investor clarification requests dropped significantly due to improved financial transparency, and the asset achieved stabilized performance ahead of projections. The project established a scalable hybrid redevelopment model supporting future acquisitions and long-term portfolio growth.